CKYC Registry

-

Customer Service Contact us Service request Locate a branch Complaints

Find all the help you need

Scan the QR, get our app, and find help on your fingertips

Help CenterSupport topics, Contact us, FAQs, Complaints and more

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

-

Login

Are you ready for an upgrade?

Login to the new experience with best features and services

- Accounts

-

Deposits

IDFC FIRST Bank Deposits

View all Deposits -

Loans

IDFC FIRST Bank Loans

View all Loans - Wealth & Insure

-

Payments

IDFC FIRST Bank Payments

View all Payments -

Cards

IDFC FIRST Bank Cards

View all Cards - Blogs

-

NRI Savings Account

IDFC FIRST Bank NRI Savings Account

View all Accounts -

NRI Fixed Deposit

- GIFT City

-

FOREX Solutions

-

Transfer to NRE

- Markets & Beyond

- Corporate Account

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services - Supply Chain Finance

-

Corporate Lending

IDFC FIRST Bank Lending

View all -

Treasury

IDFC FIRST Bank Treasury

See more details - NBFC Financing

- BRAVO (Auto Sweep)

-

MSME Accounts

IDFC FIRST Bank MSME Accounts

View all Accounts -

Trade Services

- MSME Loan

-

MSME Solutions

- Debit Card

-

Offers

-

Send funds abroad

-

Download our app

Support topics, Contact us, FAQs, Complaints and more

- IDFC FIRST Bank Accounts

-

Savings Account

-

Corporate Salary

Account -

Senior Citizens

Savings Account -

First Power

Account -

Current Account

-

NRI Savings

Account -

TASC Institutional

Account -

Savings Account

Interest Calculator

- IDFC FIRST Bank Deposits

-

Fixed Deposit

-

Recurring Deposit

-

NRI Fixed Deposit

-

Safe Deposit Locker

-

FD Calculator

-

RD Calculator

- IDFC FIRST Bank Loans

-

Personal Loan

-

Consumer Durable

Loan -

Home Loan

-

Business Loan

-

Professional Loan

-

Education Loan

-

New Car Loan

-

Pre-owned Car Loan

-

Two Wheeler Loan

-

Pre-owned Two

Wheeler Loan -

Commercial Vehicle

Loan -

Gold Loan

-

Loan Against Property

-

Loan Against Securities

-

Easy Buy EMI card

-

Personal Loan

EMI Calculator -

Education Loan

EMI Calculator -

Home Loan

EMI Calculator -

EMI Calculator

-

Personal Loan Eligibility Calculator

- IDFC FIRST Bank Wealth & Insure

-

FIRST Select

-

FIRST Wealth

-

FIRST Private

-

Mutual Funds

-

Sovereign Gold Bond

-

Demat Account

-

Term Insurance

-

Life Insurance

-

Health Insurance

-

General Insurance

-

Bonds

-

Loan Against

Securities -

Portfolio Management

Service

- IDFC FIRST Bank Payments

-

FASTag

-

Credit Card

Bill Payments -

UPI

-

Funds Transfer

-

Forex services

-

Pay Loan EMI

- IDFC FIRST Bank Cards

-

Ashva :

Metal Credit Card -

Mayura :

Metal Credit Card -

FIRST Millennia

Credit Card -

FIRST Classic

Credit Card -

FIRST Select

Credit Card -

FIRST Wealth

Credit Card -

FIRST WOW!

Credit Card -

Deals

-

Debit Cards

-

Co-branded Cards

-

Credit Card

EMI Calculator -

FIRST Corporate

Credit Card -

FIRST Purchase

Credit Card -

FIRST Business

Credit Card

- Premium Metal Credit Cards

-

Gaj: Credit CardInvite onlyZero Forex₹12,500

-

AshvaLifestyle1% Forex₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST PrivateInvite Only

- Best for travellers

-

Diamond Reserve Credit CardZero ForexTravel₹3,000

-

FIRST WOW! BlackZero ForexTravelDual Cards

-

IndiGo IDFC FIRST Dual Credit CardTravelLifestyle₹4,999

-

MayuraZero ForexMetal₹5,999

-

Ashva1% ForexMetal₹2,999

-

FIRST WOW!Zero ForexTravelLifetime Free

-

FIRST SWYPTravel OffersEMI₹499

-

FIRST Select1.99% ForexLifestyleLifetime Free

-

FIRST Wealth1.5% ForexLifestyleLifetime Free

-

Club VistaraTravelLifestyle₹4,999

- Max benefits, Free for life

-

FIRST Classic10X RewardsShoppingNever Expiring Rewards

-

FIRST Millennia10X RewardsShoppingNever Expiring Rewards

-

FIRST Select10X RewardsLifestyle1.99% Forex

-

FIRST Wealth10X RewardsLifestyle1.5% Forex

-

FIRST WOW!RewardsTravelZero Forex

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Reward Multipliers

-

Diamond Reserve Credit CardLifestyleZero Forex₹3,000

-

AshvaLifestyleMetal₹2,999

-

MayuraLifestyleZero Forex₹5,999

-

FIRST ClassicNever Expiring RewardsShoppingLifetime Free

-

FIRST MillenniaNever Expiring RewardsShoppingLifetime Free

-

FIRST SelectNever Expiring RewardsLifestyleLifetime Free

-

FIRST WealthNever Expiring RewardsLifestyleLifetime Free

- Rewards & Credit on UPI

-

Hello CashbackCashbackUPI-readyAssured

-

FIRST WOW! BlackUPIVirtualRewards

-

IndiGo IDFC FIRST Dual Credit CardUPITravelDual cards

-

FIRST Power+FuelUPI₹499

-

FIRST PowerFuelUPI₹199

-

FIRST EA₹NVirtual1% CashbackUPI

-

FIRST DigitalVirtualUPI₹199

- Fuel and Savings

-

Hello CashbackCashbackInsuranceEducation

-

FIRST PowerRewardsUPI₹199

-

FIRST Power+RewardsUPI₹499

-

LIC ClassicRewardsInsuranceShopping

-

LIC SelectRewardsInsuranceShopping

- Express and Flaunt

-

Hello CashbackCashbackUPI-readyAssured

-

Diamond Reserve Credit CardTravelZero Forex₹3,000

-

AshvaMetal1% Forex₹2,999

-

MayuraMetalZero Forex₹5,999

-

FIRST SWYPEMIOfferMAX₹499

-

FIRST MillenniaRewardsShoppingLifetime Free

- FD Backed rewarding Credit Cards for all

-

Hello CashbackCashbackUPI-readyAssured

-

FIRST WOW! BlackZero ForexTravelAssured

-

FIRST EA₹NVirtualCashbackUPI

-

FIRST WOW!Zero ForexTravelLifetime Free

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- Do more with your Credit Cards

-

Refer & EarnFriends & FamilyRewards

-

Add-onFamily members

-

Stories: Personalised Credit CardCustomImage Card₹499

-

CreditPro Balance TransferTransfer & SaveReduce InterestPay Smartly

- IDFC FIRST Bank NRI Forex Solutions

-

Send money to India-Wire transfer

-

Send money to India-Digitally

-

Send money abroad

-

Max Returns FD (INR)

- IDFC FIRST Bank MSME Accounts

-

Platinum Current

Account -

Gold

Current Account -

Silver Plus

Current Account -

Merchant Multiplier

Account -

Agri Multiplier

Account -

TASC Institutional

Account -

Dynamic Current

Account -

World business

Account -

First Startup

Current Account -

EEFC Account

-

RERA Account

-

Other Accounts

- IDFC FIRST Bank Business Loans

-

Business Loan

-

Professional Loan

-

Loan Against Property

-

Business Loan for Women

-

Working Capital Loan

-

Construction Equipment Loan

-

Machinery Loan

-

Healthcare Equipment Loan

- IDFC FIRST Bank Business Solutions

-

Payment Solutions

-

Tax Payments

-

Doorstep Banking

-

Point of Sale (POS)

-

Escrow Accounts

-

NACH

-

Payment Gateway

-

UPI

-

Virtual Accounts

-

As per amendment in the Income Tax Rules, PAN or Aadhaar are to be mandatorily quoted for cash deposit or withdrawal aggregating to Rupees twenty lakhs or more in a FY. Please update your PAN or Aadhaar. Kindly reach out to the Bank’s contact center on 1800 10 888 or visit the nearest IDFC FIRST Bank branch for further queries.

-

-

Scan, get our app

Access 300+ features on our 4.9⭐️ rated app

Most Searched

Sorry!

We couldn’t find ‘’ in our website

Here is what you can do :

- Try checking the spelling and search

- Search from below suggestions instead

- Widen your search & try a more generic keyword

Suggested

Get a Credit Card

Enjoy Zero Charges on All Commonly Used Savings Account Services

Open Account Now

Personal Banking

Building a world class bank in India

Guided by ethics, powered by technology and a force for social good

Know more about the bank Know more about the bank

Select a

Select a Product

Apply for a product now

On a mission to build the world’s most customer friendly bank

-

Savings Account

Savings Account

-

FIRST Select Credit Card

-

Corporate Salary Account NEW

Corporate Salary Account NEW

-

FIRST Wow! Credit Card NEW

-

Personal Loan

-

Business Loans

Business Loans

-

Home Loan

-

Two Wheeler Loan

-

Pre-Owned Two Wheeler Loan

-

Non-Resident Indian Savings Account

-

Fixed Deposit

-

Loan Against Property

-

New Car Loan

-

Pre-owned Car Loan

-

Consumer Durable Loan

-

FASTag

FASTag

-

Forex services

Women's Savings Account

Earn Monthly Interest Credits of up to 6.50% p.a.

Enjoy Zero Fee Banking on All Savings Account services

Up to 50% discount on 1st year locker rentals

Unlock exclusive debit card offers

Gaj: Credit Card

By invitation only | Metal Credit Card with ZERO Forex Markup | Up to 33.33% value back on credit card spends

Gold Loan

Competitive and fixed interest rates with no step-up, starting from 0.90% p.m.

Personalized

View offers tailored just for you!

Debit Card

Exclusive discounts across 15+ merchants

Credit Card

Discover the best deals on 300+ top brands

Current Account

Discover 100+ exclusive offers for your business needs

Forex Services

Save big while remitting money

What makes us special?

We truly mean it when we say we want to be the most customer-friendly bank

We truly mean it when we say we want to be the most customer-friendly bank

A world-class cutting-edge Corporate Banking Portal with unique industry-first features, such as a single window experience, intelligent report builder capability, and unique online trade regulatory portal

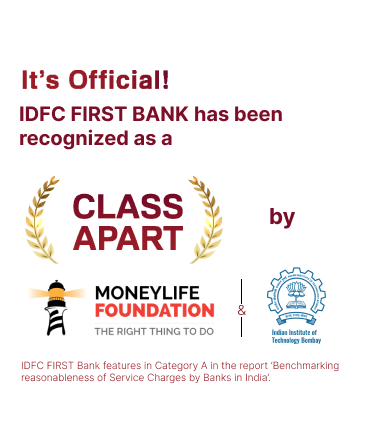

IDFC FIRST Bank recognized for its fairness in service charges on Savings Account by Moneylife Foundation & IIT Bombay

With IDFC FIRST Bank Savings Accounts, interest is credited each month, unlike most other banks that offer quarterly interest pay-outs.

Grow your savings faster with interest rate of up to 6.50% p.a. on balances above ₹10 Lakhs and up to ₹10 Crores.

We offer unlimited free cash transactions at non-home branches, whereas most banks charge between ₹100 and ₹150 per transaction.

Enjoy daily limits of up to ₹2 lakh on ATM withdrawals and up to ₹6 lakh on POS transactions with the ₹25,000 AMB Savings Account variant.

Our dynamic annual percentage rates (APRs) start at 8.5% - 46.2% per annum versus the usual market rates of 42% per annum.

Instead of a fixed catalogue, reward points can be redeemed against your online purchases and select offline purchases, too.

Spend your reward points whenever you like. Unlike most banks, where rewards expire in 2-3 years, most of our credit cards offer reward points that will never expire.

With our credit cards, ATM cash withdrawals attract no interest until the due date, whereas most banks charge interest rates of 42% per annum from the withdrawal date.

Get up to 200% of your fixed deposit as a credit limit, while earning up to 6.75% interest per annum on your fixed deposit. Also, enjoy 0% forex markup on this credit card.

Your complete mobility solution when on the road with Tolling+Fuel+Parking payment capabilities enabled on a single FASTag

Top-up on the go with a few simple WhatsApp clicks. We are the first bank to enable FASTag recharges through WhatsApp Payments

Experience state-of-the-art features such as Google-like search, Personal Finance Management, Customer Service Support, Mutual Fund Investing , ASBA-IPO facility, and much more.

With research-backed curated funds with a forward-looking guidance, AIFs, PMS, paperless Demat Account opening, offshore investment solutions, and more

Convenience at your fingertips with our digital NRI Savings Account which offers monthly interest credits, dedicated relationship manager, one-click Portfolio Investment Scheme’ (PIS) Account opening, ZERO-fee fund transfers, and more!

Enjoy fast processing and competitive interest rates on home loans, business loans, education loans, and car loans tailored to your personal or business needs.

No minimum balance requirement for the first 3 years and unlimited free NEFT, IMPS & RTGS transactions for easy cashflow management

Be part of a uniquely designed startup program that gives you access to mentorship, networking, and fundraising opportunities through a meticulously planned journey

A world-class cutting-edge Corporate Banking Portal with unique industry-first features, such as a single window experience, intelligent report builder capability, and unique online trade regulatory portal

Enjoy many complimentary offers across best-in-class apps for ERP, HRMS, Payroll, Taxation, Legal Advisory, Logistics, Society Management, among others.

Zero fee banking

The only bank in India to offer Zero Fee Banking on all Savings Account services

ZERO

CHARGES on

IMPS

NEFT

RTGS

Cheque Book

SMS Alerts

Cash Transactions

3rd Party Cash Transactions

Manager’s Cheque/DD/PO

Duplicate Statements Issuance

Duplicate Passbook Issuance

Balance Certificate Issuance

Interest Certificate Issuance

Account Closure

ECS Return

Stop Payment of Cheque

International ATM/POS Transactions

Decline Charges for Insufficient Balance

Standing Instructions

Photo Attestation

Signature Attestation

Retrieval of Transactional Records

Address Confirmation

Deliverable Returned by Courier

Debit Card Issuance

Cash Deposit at ATM

ATM Transactions

Cheque Bounce

Doorstep Banking

ZERO

CHARGES on

IMPS

NEFT

RTGS

Cheque Book

SMS Alerts

Cash Transactions

3rd Party Cash Transactions

Manager’s Cheque/DD/PO

Duplicate Statements Issuance

Duplicate Passbook Issuance

Balance Certificate Issuance

Interest Certificate Issuance

Account Closure

ECS Return

Stop Payment of Cheque

International ATM/POS Transactions

Decline Charges for Insufficient Balance

Standing Instructions

Photo Attestation

Signature Attestation

Retrieval of Transactional Records

Address Confirmation

Deliverable Returned by Courier

Debit Card Issuance

Cash Deposit at ATM

ATM Transactions

Cheque Bounce

Doorstep Banking

Financial Calculators

Hassle-free financial planning with IDFC FIRST Bank

**Interest calculated considering quarterly interest credit (Most universal banks credit savings interest quarterly).

See interest comparison

We offer higher interest rates compared to other banks with monthly payouts, helping your savings grow faster than other banks.

| Your bank | IDFC FIRST bank | |

|---|---|---|

| Payout cycle | Quarterly | Monthly |

| Int. earned | ₹ 60,678/yr | ₹ 1,23,926/yr |

Interest slabs used for rate comparison:

3.00% p.a. for

<=₹1L

6.50% p.a. for

₹10L - ₹10Crs

All amounts mentioned are average monthly balance amounts.

Disclaimer

Interest you earn with IDFC FIRST Bank is the interest calculated considering monthly interest credit with the power of monthly compounding and on progressive balances in each interest rate slab, as applicable.

Interest you earn with other banks is the interest calculated considering quarterly interest credit (Most universal banks credit savings interest quarterly).

In the spotlight

Quick actions for you

Activate UPI

Get the Power of UPI and earn cashback up to ₹200

FASTag

Upgrade to FASTag Max and enjoy benefits worth ₹5000*

Dining Offers

Avail up to 25% discounts with live screening of T20 matches

Professional Loan

Enjoy unsecured loans up to ₹1 crore tailored for Doctors, CAs, and Architects

Explore Bikes

and ride your dream bike with an instant loan

FIRST Rewards

Our exclusive Savings Account loyalty programme

Explore Cars

Shop, compare and choose your perfect car with the best financing options

Activate UPI

Get the Power of UPI and earn cashback up to ₹200

FASTag

Upgrade to FASTag Max and enjoy benefits worth ₹5000*

Dining Offers

Avail up to 25% discounts with live screening of T20 matches

Professional Loan

Enjoy unsecured loans up to ₹1 crore tailored for Doctors, CAs, and Architects

Explore Bikes

and ride your dream bike with an instant loan

First Rewards

Our exclusive Savings Account loyalty programme

Explore Cars

Shop, compare and choose your perfect car with the best financing options

Award-winning digital banking platform

Recognised as the 'Best Digital Bank' for the year 2021-2022 by Financial Express India's Best Banks Awards 2023.

Enjoy India's #1 Mobile Banking App

Enjoy India's #1 Mobile Banking App

Enjoy India's #1 Mobile Banking App

Download IDFC FIRST Bank App

Start banking with just a

WhatsApp message. Send

'Hi' to 95555 55555

Experience a secure way

to bank on the go with

our mobile banking app

Banking services now

at your fingertips

anytime, anywhere

Step inside the

world of smart

watch banking

But don’t take our word for it, Hear from our customers

"This compliment is about Mr. Hiren Patel, who looks after credit card business in Vadodara and is based at Old padra road branch. He has been exceptional in his response, and speed...." Keval Parmar 12 January 2026

"Mr. Aniket Mithbawkar, Relationship Manager at IDFC Bank, for the outstanding service he provided during my recent interactions with the IDFC services team. Mr. Mithbawkar guided me..." Shri Rath 10 January 2026

"Thank you for not logging out from the app when sim card changed. Thank you for treating the app seperate from the mobile phone's state. I have been saved by the idfc first app so many times as this..." Ankit Yadav 09 January 2026

"I just bough a product from reliance digital store through idfc finance.. idfc representative souren manna is very good at his work. Good experience..." Subrata Kumar Hazra 09 January 2026

"Very happy with the Video KYC services. the agent was helpful and patient with me throughout the call." Akshay Bhatnagar 07 January 2026

"Hey hi idfc first bank your staff rithika had explained very clearly about my requirement and she explained very detailed thank you rithika" Helen Lourd Mary 05 January 2026

"Dear IDFC First Bank Team, I would like to share my positive experience with opening an NRE Savings Account with IDFC First Bank. For the past two years, I had been stressed about how to..." Anirudh Allani 01 January 2026

"Dear IDFC First Bank Team, I would like to share my positive feedback regarding the support provided by your executive Mr. Rohit. Mr. Rohit was very helpful in reminding me about my EMI..." Rahul Singh 28 December 2025

"The latest CIBIL score improvement system by IDFC First Bank is truly inspiring and forward-thinking. It reflects a customer-centric policy that rewards financial discipline..." Chetan Chandrakant Katkar 26 December 2025

"Lovely service, humble employees and superfast account opening. Kudos to my RM for the speedy response and timely resolution of my queries." Rohan Kumar Singh 24 December 2025

Learn how to manage your finances effectively

Awards & Accolades

A glimpse of IDFC FIRST Bank's testament to excellence

Know more

IDFC FIRST Bank recognized amongst the 'World's Best Banks 2025’ by Forbes in partnership with Statista

![]()

![]()

IDFC FIRST Bank wins the 'Digital Sourcing & Decisioning Excellence' award at Lentra CNBC-TV18 Digital Lending Summit

![]()

![]()

Helping our communities grow with us

9.3 Million Beneficiaries

Supported since March 2023

70,000 Villages

Served across the country

9000 Residents

Impacted positively through our Swachh Worli Koliwada program

351 Students

Awarded post-graduate scholarships this year

9.3 Million Beneficiaries

Supported since March 2023

70,000 Villages

Served across the country

9000 Residents

Impacted positively through our Swachh Worli Koliwada program

351 Students

Awarded post-graduate scholarships this year

Disclaimer: With IDFC FIRST Bank Savings Accounts, enjoy Zero Charges on all Savings Account services. These services are being offered free in good faith, and in case of misuse of services, the Bank reserves the right to levy charges. Forex mark-up fee will be applicable on International ATM/POS/Debit card transactions. T&Cs are subject to periodic changes. All rights reserved.